One in seven SMEs has experienced a crisis in cash flow that left them unable to pay their employees. A well-versed accountant can help organisations to create meaningful profits while maintaining an in-depth financial forecast so businesses can make better choices in the Accountant help long run. As your business expands, be aware of the time you spend on accounting and reflect on how much that time costs your business. If the burden of handling all your accounting needs becomes to great, you might want to seek the help of a professional accountant.

- In the fast-paced business world, accurate record-keeping is paramount for success.

- For the tasks described at the beginning, a personal bookkeeper is what you’ll need.

- A return on a real estate investment can get tricky, and a professional can help you figure out what kinds of deductions you may be entitled to.

- Our tax planning services are designed to help you, your family, and your business utilize the tax code more effectively.

“There can be a lot of loopholes that you’re not going to be aware of, especially with tax laws changing,” Cordano explained. The so-called revolving door, in which people cycle between the public and private sectors, is nothing new. But the ability of the world’s largest accounting firms to embed their top lawyers inside the government’s most important tax-policy jobs has largely escaped public scrutiny. An accountant will analyze your cash flow reports and other financial documents to determine where your business’ money is going. They will use that information to advise you on where you can make improvements in your processes and cash flow, set new budgets and update workflow.

SME scale-up on a budget: How to grow your business efficiently

The top tax official in President Donald J. Trump’s Treasury Department was David J. Kautter. In addition to serving as assistant Treasury secretary for tax policy, he had a stint as acting I.R.S. commissioner. The meeting took place before the first draft of the proposed rules was even made public, which meant that, right off the bat, Ms. Ellis’s former PwC colleague and his client had an inside track.

The bookkeeper can set up accounts (which operate like folders) that you place your information in. By creating accounts that resemble the same categories used for tax purposes, you simplify tax return preparation (whether you do this or you use a paid professional). You don’t need to be an accounting expert to run a small business, but you’ll want to have a few basic accounting skills in your back pocket to make sure your business runs smoothly and is on track to make money. This guide takes you through the essentials of small business accounting and offers some time-saving financial tips to set your company up for success.

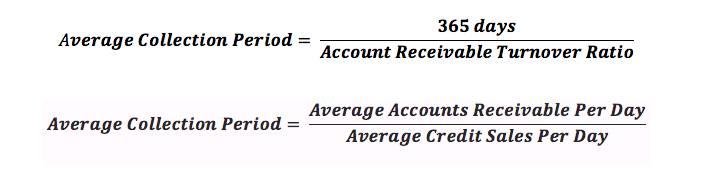

But growth comes with even more responsibilities on the not-so-fun side of your business. You know what we’re talking about—that always-growing pile of receipts, bills and pay stubs. Add in accounts receivable and taxes (ugh), and it’s easy to feel like you’re drowning. 34% of SMEs experience late payments, causing a significant blockage in their regular cash flow, having to chase up customers endlessly. It is critical to note that it is impossible to remove the risk of late payments entirely.

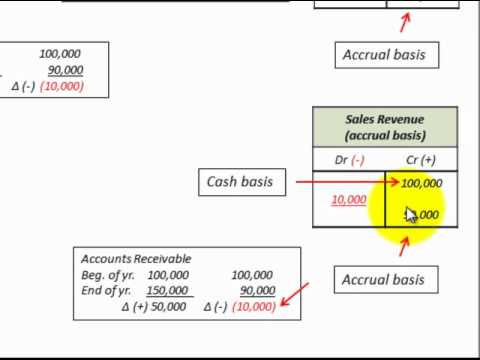

An accountant needs to be able to break down complex financial info so owners and staff can understand and use it. They look at those numbers the way a business owner (like you) would. That means they can use what they see to help with the strategy side of your business. To run an effective organisation, executives must understand the incoming and outgoing cash flow, including cash receipts, operating expenses, and sales volumes.

With an accountant on hand to analyze and perfect your financial statements, reporting at your small business just got a whole lot easier. Whether it’s your tax filings, a shareholders’ report or a new budget to show the executive team, they will help you achieve financial clarity in your business. Your accountant will then help you interpret your financial data.

Other Jobs You Can Get with an Accounting Degree

You may turn to the internet when conducting your accountant search. But Dubrow warns against hiring someone you find on Google or meet only via an online directory. Finally, our self-employment tax rate calculator will tell you what percentage of your 1099 income you should set aside for taxes. If you think you should be paying quarterly taxes, use our quarterly tax calculator to figure out how much your payments should be (or if you should even make them). Over the course of the year, Ms. Ellis met with lobbyists for the insurance, auto and banking industries. Companies wanted to water down the new taxes on offshore revenue and profits.

The next week, the Treasury granted their wish — a decision potentially worth billions of dollars to PwC’s clients. A CPA license won’t disqualify you from any accounting position. Most often, it is seen as a benefit, even when it isn’t necessary for the job. CPAs must also perform continuing education on a yearly basis in order to maintain their knowledge of best-practice accounting standards. While CPAs and accountants perform similar tasks, there are multiple differences in the functions they perform. Founded in 1932, and online since 1995, we’ve helped countless students reach their goals with flexible, career-focused programs.

Due to the complex nature of the Swiss tax and retirement system, successfully meeting all US and international requirements for tax filings is difficult without an experienced CPA working with you. Today’s accountants are way more than number crunchers—think of them as financial weather people. They use their data analysis skills to keep a sharp eye on your finances and track patterns that can help them (and you) predict future opportunities—keeping you ahead of the curve. If you run a small business, you might think that you can handle your accounting and tax matters on your own. However, hiring a professional accountant can offer you many benefits that can save you time, money, and stress. Here are some ways that a professional accountant can help your small business.

In January 2017, Mr. Berk’s office issued new regulations that made it easier for companies to shift their profits offshore to avoid U.S. taxes. The most important change mirrored what Mr. Berk had sought in his letter eight months earlier. But companies’ tax advisers protested that the Treasury was going too far. Mr. Sloan and some other industry officials said they didn’t see anything wrong with this practice because the lawyers brought expertise to government.

Is an Accountant Worth It for a Small Business?

“It took me about four and a half years to get my master’s because I was working full-time as a teacher,” Conticchio said. “Because of my demanding schedule, I could only manage one class at a time. As for Stephens, she joined the field as a county auditor before moving into local government, where she spent 25 years. If you become an accountant, what you do will also depend on your role and where you work.

One of the most active lobbyists was Mr. Harter’s former PwC colleague Ms. Olson, who had been the top tax official in the Bush administration’s Treasury Department. Two weeks after sending the letter, Mr. Berk left Deloitte’s Washington offices and moved a few blocks west to work for the Treasury. His assignment was to oversee the regulations he had just been pushing to water down. Mr. Manousos and Mr. Gerson referred questions to PwC, which declined to comment on behalf of its employees. In July 2015, the department issued proposed regulations that essentially created a road map for how to construct waivers without running afoul of the I.R.S.

If your business isn’t big enough to hire a CFO but you’d benefit from tailored financial advice, you can outsource. „These strategies help clients make sure that a greater percentage of their assets go toward organizations that provide social good.“ Having a accountant who understands your financial position can help you present the purpose of the loan and consider various options for financing. But we have to do it, so it’s good to know what the small business tax rates are for 2020—if for no other reason than to keep the IRS off your back. Just like in any professional relationship, communication is key.

On demand business valuations at your fingertips

Sanay is a full-service finance partner ready to help you grow your business to achieve its full potential. Whether it’s cash flow issues or lack of clarity in financial decisions, Sanay’s expert finance team can add immediate value to your business. For 71% of small and medium business owners, cash flow problems are one of the leading causes of concern for their operation. This article will explore how accountants can lend a helping hand to leaders to get the most out of their business through efficient cash flow management.

Certified Management Accountant (CMA)

Will Lopez, head of accountant community at Gusto, says accountants are perfectly positioned to help clients figure out how to grow their business with smart hiring. Usually, Kesler continues, accountants help clients gather the information and data necessary for a loan, from quantifying the current financial condition and credit need to identifying repayment sources. With this data, accountants can also work with clients to craft compelling loan applications that can improve the chances a bank will approve the request. CPAs have to pass an exam (and meet a few other requirements) before they can get their license through the state. Once they’re officially a CPA, they’re allowed to prepare and sign tax returns for individuals and businesses and can represent taxpayers before the IRS for audits.

About Ted Kleinman, CPA

With the help of an experienced CPA you can lower your tax, minimize or eliminate certain interest and penalties, and avoid tax liens and levies by acting now. The IRS dedicates significant resources to collect taxes in the following countries. The IRS has established several programs that offer eligible taxpayers reduced penalties in exchange for the voluntary disclosure of unreported income and accounts.

Tax reporting for individuals working there requires specialized knowledge. Make sure you receive proper benefits for putting your life at risk. I’m a CPA with experience in combat zone designations, hypothetical tax, and tax equalization. I’ve lived and worked in Saudi Arabia and have a keen insight into these issues. Customize your experience.Get certifications, training and new clients.Gain more revenue or delegate work.

Organisations can miss out on a large sum of money if they cannot correctly identify what items they can expense for their business. Accountants have excellent knowledge regarding rules and regulations and can spot any missed opportunities to adjust a company’s cash flow through expensing. Financial partners can also identify any outgoings that can be cut back or replaced by a cheaper alternative to help balance the scales.